(Unintentionally) Smart Marketing

I did something today I haven’t done in 10 years – I applied for a retail credit card.

Now, before you write me off as a sucker, I’d like to explain myself and highlight an important concept I’ve been preaching.

I went to Nordstrom Rack to buy a few pairs of jeans, and while checking out, the cashier gave me the typical pitch:

Cashier: “Are you a Nordstrom Cardholder?”

Me: “No.”

Cashier: “Would you like to apply for membership. You…”

Me: “No thank you.”

Cashier: “We are offering a $40 credit and 0% for…”

Me: “I’m good – thank you.” (It could have been 0% for eternity, and I would have still said no.)

Cashier: “You will get exclusive invitations to our private trunk shows, and there is no annual fee.”

Me: “I’m good.”

Cashier: “Okay. But are you aware that we provide unlimited free alterations?”

Me: “Wait. What did you say?”

Cashier: “As a cardholder, you get free alterations. And not just on things you purchase here. You can bring in clothes you purchased elsewhere, and we’ll do those as well.”

Me: “Wow. Ok, sign me up.”

Considering the alterations on the jeans I just purchased were going to run me at least $50, it was a no-brainer . In fact, I recently spent $500 on alterations (I’ve been on a roll at the gym).

I recently wrote about how I acquired many new clients who were not in the market for my services when we met. The key lies in getting on the radar of your potential new clients by providing benefits that typically have nothing to do with your core service or offering.

Not only was I indifferent to a new card, but I would have told you that you could bet your life’s savings on me not applying for a credit card that day. However, given how much I spend on alterations, signing up for a Nordstrom credit card was a great deal.

They disrupted my indifference by offering something on the fringes of their primary offering that was appealing to me. This perk got me to sign up for a new card, and I’m sure it is a great way for them to retain existing cardholders while avoiding the problem with Passive Loyalty.

Ironically, the free alterations perk was the fourth benefit the employee mentioned to me while touting the benefits of the card.

That got me thinking – a lot of people would not have stayed in the conversation as long as I did because they aren’t as patient as I am. (HA! Who am I kidding? She just caught me on a good day.) I wondered why she didn’t mention this first.

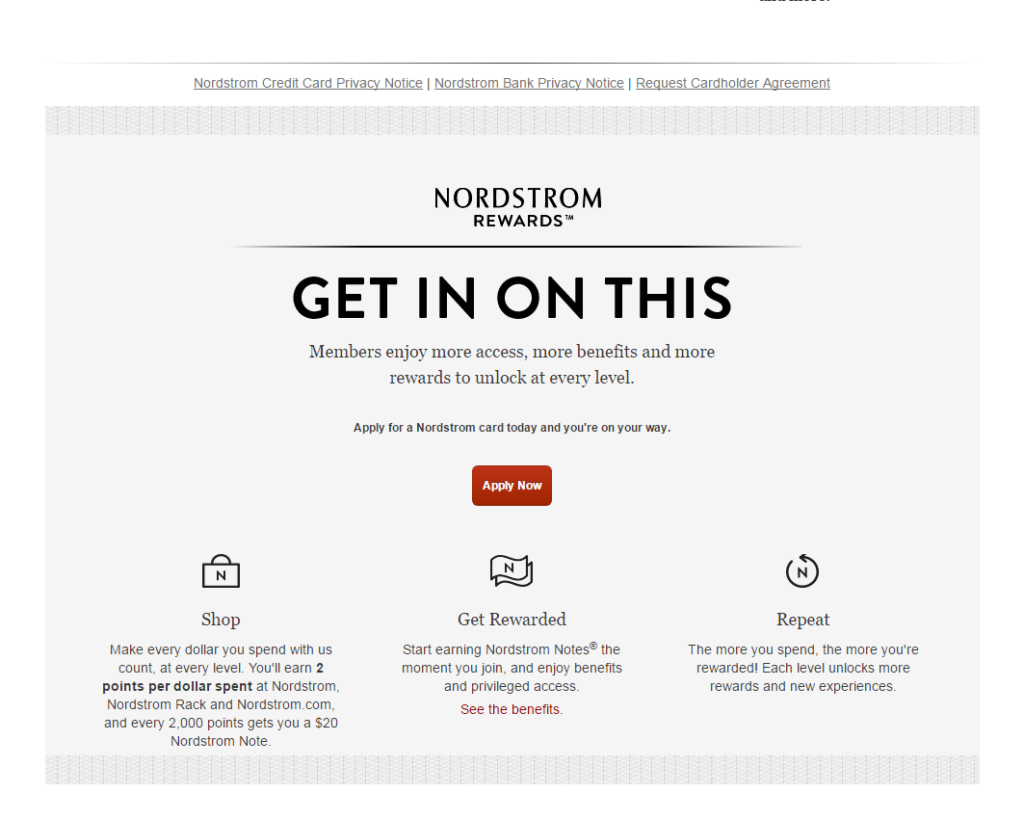

When I returned to my office, I went to the Nordstrom credit card website to see how the free alterations perk was positioned on the feature list. It wasn’t even on the primary page! Here’s the screenshot:

As you can see, it was nowhere to be found. I actually had to Google “Nordstrom Card Alterations” to see information on this benefit.

Since this is a credit card, Nordstrom/Visa thinks they will get new customers by highlighting their primary features. Like most businesses, they are burying the lead.

As I’ve said before, there is likely a very small market, if any, of folks who will leave their existing provider for you based on lower fees or better service. The benefit that wins them over almost always has to be a benefit that is completely independent of your core service.

For me, it is all about creating events and experiences for my clients to share with their friends. For the Nordstrom/Visa bank credit card, they are offering free alterations.

What do you do or offer that is different than your competition? Are you offering any benefit that is completely independent of your core service as a way to get the attention of prospective clients?

If you liked this post and and think a friend or colleague could benefit from it, please feel free to share it with them!